Do you often feel overwhelmed with all the tasks you have to complete in a day? If so, a printable daily planner could be just what you need to help you stay organized and on track. With a daily planner, you can jot down your to-dos, appointments, and goals all in one convenient place.

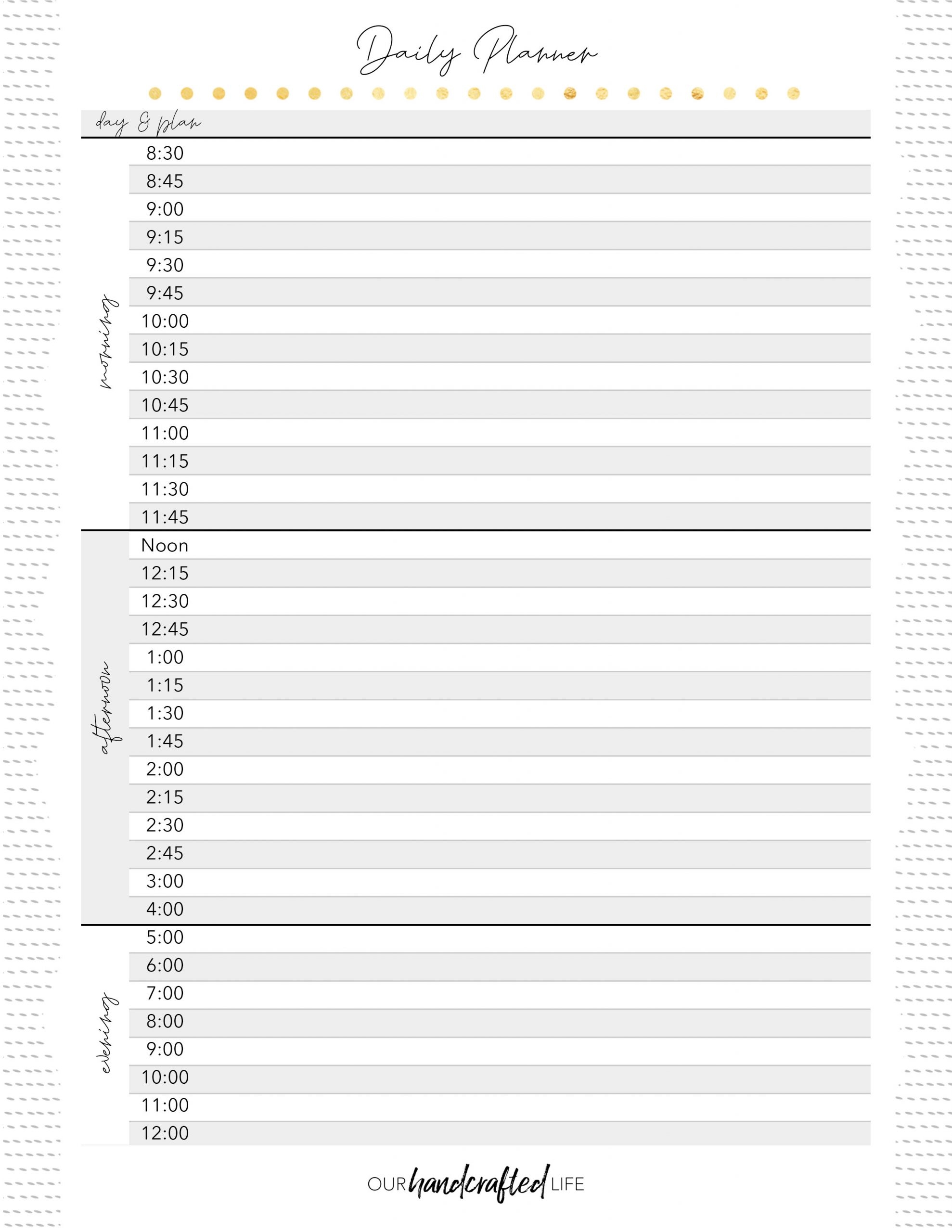

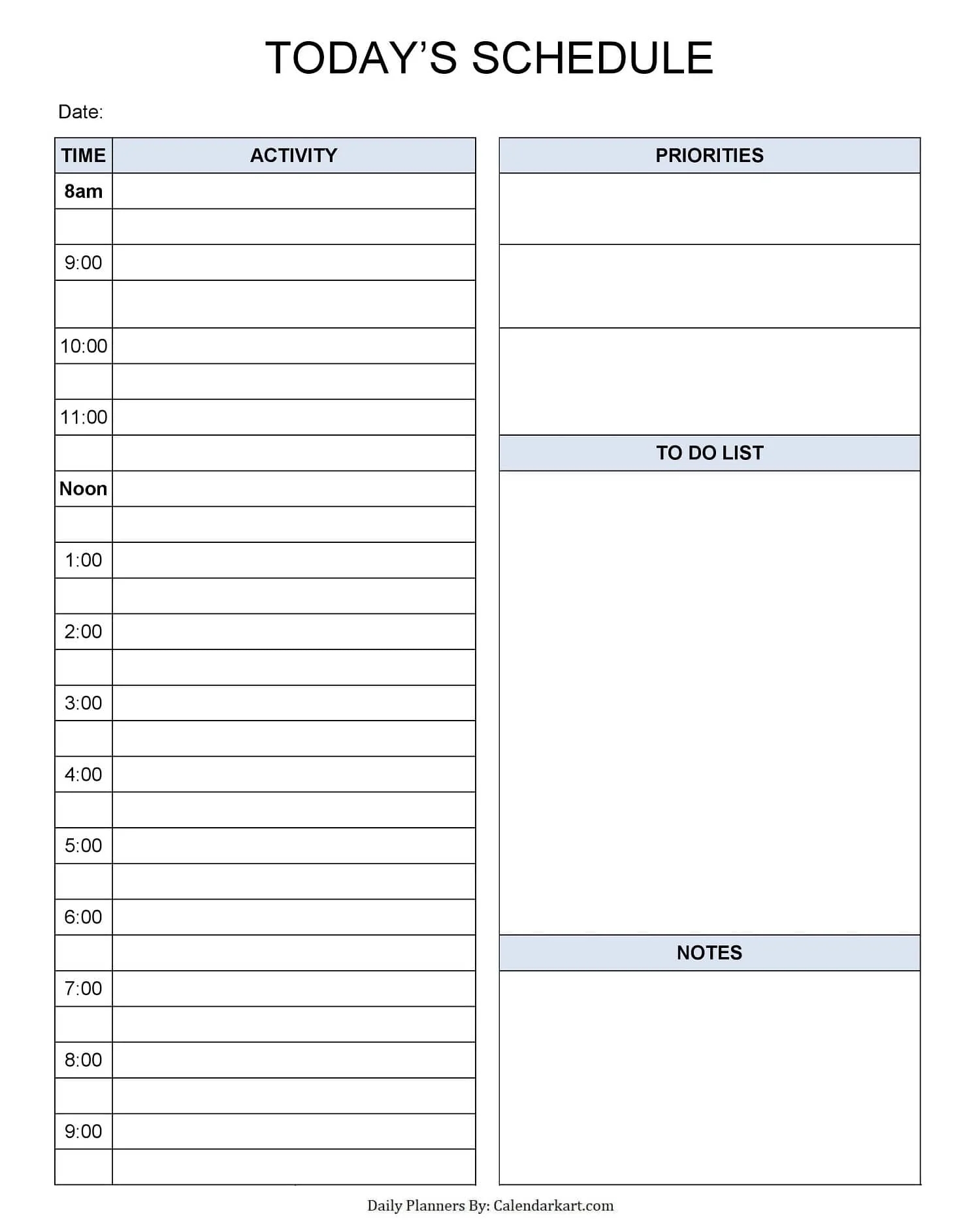

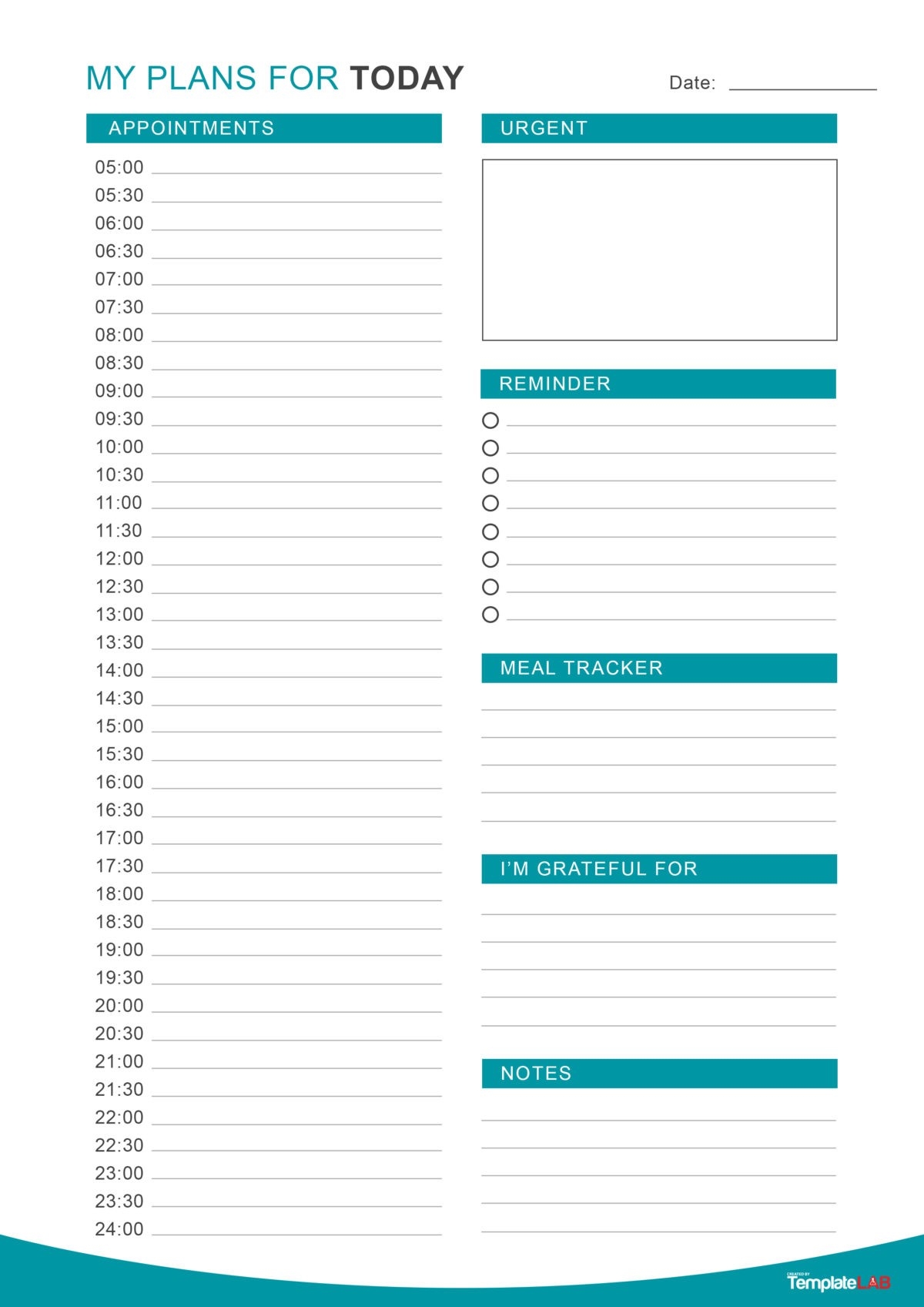

Printable daily planners come in a variety of styles and designs, so you can choose one that suits your personal preferences. Whether you prefer a simple layout or a more detailed planner with sections for meal planning, exercise, and more, there is a printable daily planner out there for you.

Printable Daily Planner

Printable Daily Planner: Stay Organized and Productive

One of the great things about printable daily planners is that you can customize them to fit your unique needs. If you have a busy schedule, you can allocate specific time slots for each task to ensure you stay on track throughout the day.

Not only can a daily planner help you stay organized, but it can also boost your productivity. By writing down your tasks and goals, you are more likely to follow through and accomplish what you set out to do. Plus, crossing off completed tasks can give you a sense of accomplishment and motivation to tackle the rest of your to-dos.

Printable Daily Planner Template Calendarkart

Another benefit of using a printable daily planner is that it can help reduce stress and anxiety. When you have all your tasks and appointments written down, you can see what needs to be done and prioritize accordingly. This can help prevent last-minute rushes and forgotten obligations, leading to a more peaceful and organized day.

Get Started with a Printable Daily Planner Today

If you’re ready to take control of your day and increase your productivity, why not give a printable daily planner a try? There are plenty of free templates available online that you can download and print at home. Simply choose one that resonates with you, print it out, and start planning your days more efficiently.

25 Printable Daily Planner Templates FREE In Word Excel PDF

Remember, consistency is key when it comes to using a daily planner. Make it a habit to fill out your planner each night for the following day, and you’ll soon see the positive impact it can have on your productivity and overall well-being. So why wait? Start using a printable daily planner today and take the first step towards a more organized and fulfilling life.